EUR/GBP Hovers Ahead of BoE Rate Decision

EUR/GBP Hovers Ahead of BoE Rate Decision

EUR/GBP traded near 0.8710, as investors await the Bank of England (BoE) interest rate decision on Thursday. Traders remain optimistic that the BoE will lower interest rates during its August meeting on Thursday, given a series of weaker UK economic indicators and signs of a pause due to persistent price pressures that are well above the 2% target. Markets have already factored in two more cuts, which would bring interest rates down to 3.5% by next summer. In June, the UK’s CPI rose to 3.6% year-on-year, surpassing predictions and the previous rate of 3.4%. Meanwhile, UK house prices experienced a modest increase in July, with the Nationwide House Price Index reporting a 2.4% annual growth rate, up from 2.1% in June. Additionally, weakening labour market indicators, such as declining payrolls, rising unemployment, and slower wage growth, have increased the likelihood that the central bank may need to act sooner rather than later.

In the Eurozone, consistent growth in the preliminary Eurozone Harmonised Index of Consumer Prices (HICP) data for July has reduced expectations of further interest rate cuts by the European Central Bank (ECB), restraining the euro’s decline. The HICP data indicated a rise of 2% over the year in July, at the same pace seen in June, slightly above the forecasted 1.9% print. The core HICP rose 2.3% year-over-year (YoY) in July, matching June’s 2.3%, but below the 2.2% forecast. On a monthly basis, the bloc’s HICP inflation was 0% in July, down from June’s 0.3%. The core HICP fell 0.2% month-over-month (MoM) during the same period, after increasing by 0.4% in June. US President Donald Trump announced a 15% tariff cap on most EU exports, covering items like automobiles, semiconductors, consumer goods, and pharmaceuticals. This move avoids potentially higher rates of 30% or more. It represents a de-escalation after months of discussions and tension, boosting optimism about US-EU trade agreements. Such optimism could strengthen the EUR, while any signs of renewed trade tensions might support the GBP.

The upcoming Bank of England (BoE) interest rate decision and hopes regarding US-EU trade agreements will influence market sentiment towards the EUR/GBP exchange rate.

USD/CHF Rebounds Amid Tariff Jitters

USD/CHF rebounded near 0.8088 as US President Trump announced a 39% tariff on Swiss goods, weakening the Swiss Franc. The new US tariff on Swiss goods exceeds the initially proposed 31% rate from April, reducing chances for a negotiated deal. The Swiss government expressed “great regret,” noting that the final tariff “differs significantly” from the earlier draft discussed. On Thursday, US President Donald Trump signed an executive order imposing tariffs scheduled to start on August 1. These tariffs, ranging from 10% to 41%, will affect US imports from numerous countries, including Canada, India, and Taiwan, following the failure to reach a trade agreement deadline. On Friday, Swiss President Keller-Sutter expressed strong concerns about the newly imposed 39% tariff, describing it as “very bad for the Swiss economy” and particularly harmful to key export sectors, including machinery and luxury watches. Although pharmaceuticals are still exempt, she pointed out that this sudden increase far surpasses previous discussions, stating, “previous discussions had been very constructive. A 39% tariff is much higher than what was negotiated.” Keller-Sutter also mentioned that Switzerland, which already has zero industrial tariffs and has committed to investments in the US, finds it “very difficult to offer more concessions.” She affirmed that Bern remains in contact with US officials and is seeking a diplomatic solution to prevent further economic damage. Recent data from the Swiss Federal Statistical Office, released on Thursday, further increased demand for the safe-haven Swiss Franc. Real Retail Sales grew 3.8% YoY in June, significantly surpassing the 0.2% forecast and rising from May’s revised 0.3% (initially 0%). Monthly retail sales also rose 1.5% in June, bouncing back from a revised 0.4% decline in May and marking the first positive figure in five months.

On the greenback front, softer-than-expected labour market data, along with ISM Manufacturing PMI, reduced the appeal of the US dollar. US Nonfarm Payrolls (NFP) grew by 73,000 in July, according to the US Bureau of Labour Statistics (BLS) on Friday. This increase follows a revised 14,000 gain in June (originally 147,000) and falls short of the market expectation of 110,000. The report also showed that the Unemployment Rate rose slightly to 4.2% from 4.1%, as anticipated, while the Labour Force Participation Rate dipped modestly to 62.2% from 62.3%. Additionally, annual wage inflation, indicated by the rise in Average Hourly Earnings, edged up to 3.9% from 3.8%. Following the weaker-than-expected jobs data, the Trump administration dismissed BLS Commissioner Erika McEntarfer. This action may be part of a broader effort to cast doubt on official inflation figures, with potential repercussions for markets and Federal Reserve policy discussions.

Investors will closely monitor the US factory order data, trade balance, and service inflation figures, as well as developments in trade tariffs, to gain fresh insights into the USD/CHF exchange rate.

AUD/JPY Gains Due to Risk-Off Sentiment

AUD/JPY hovered around 95.82 following Australia’s inflation data release. The TD-MI Inflation Gauge increased by 0.9% month-over-month in July, a significant jump from June’s modest 0.1% rise and the sharpest since December 2023. Meanwhile, the annual inflation rate held steady at 2.4%. This monthly rise heightens concerns for the Reserve Bank of Australia (RBA), given ongoing uncertainties in supply chains and consumer demand. Furthermore, President Donald Trump’s decision to keep 10% baseline tariffs on Australian goods unchanged lent some support to the AUD. Australia’s Producer Price Index (PPI) increased by 0.7% quarter-on-quarter in the second quarter, below the expected and previous rise of 0.9%. The annual PPI grew 3.4% in Q2 compared to 3.7% previously. Meanwhile, China’s Caixin Manufacturing Purchasing Managers Index (PMI) declined to 49.5 in July from 50.4 in June. This figure was below the market forecast of 50.3. Australia’s Trade Minister Don Farrell stated on Friday that the White House had confirmed that no country benefits from lower reciprocal tariffs than Australia. He added that this gives Australian products a competitive edge in the US market, potentially boosting exports. “We will support all our exporters in taking full advantage of this opportunity to increase export volumes,” Farrell said.

On the global stage, the US and China did not reach an agreement to extend the 90-day tariff pause during their recent talks in Stockholm, Sweden. This pause is set to end on August 12, with the final decision now up to US President Donald Trump. Meanwhile, US tariffs have been reduced from 145% to 30%, and Chinese tariffs from 125% to 10%. US Treasury Secretary Scott Bessent expressed optimism on Thursday, believing that a trade deal could be within reach as a key tariff deadline approaches. He stated, “I believe that we have the makings of a deal.” He added, “There are still a few technical details to be worked out on the Chinese side between us. I’m confident that it will be done, but it’s not 100% done.” China’s Finance Minister Lan Fo’an said on Tuesday that China will increase fiscal support to boost domestic consumption and counter growing economic challenges. He highlighted the increasing uncertainty surrounding China’s development environment and indicated Beijing will pursue more proactive fiscal policies to stabilise growth.

On the Yen’s front, the Bank of Japan (BoJ) last week acknowledged the uncertainty surrounding the economic impact of higher US tariffs and signalled continued policy patience, which weighed on the currency. The BoJ revised its inflation forecast at the end of the July meeting and reiterated that it will continue to raise the policy rate if the economy and prices develop in line with the forecast. BoJ Governor Kazuo Ueda, however, downplayed inflation risks and did not show any immediate intention to hike rates. Ueda further added that the BoJ will assess incoming data without preconceptions and make appropriate decisions at each meeting. Moreover, the ruling Liberal Democratic Party’s loss in July suggests that prospects for BoJ rate hikes could be delayed further, which is seen as putting pressure on the JPY.

Domestic political uncertainty within Japan and US-China trade talks will significantly influence the AUD/JPY exchange rate.

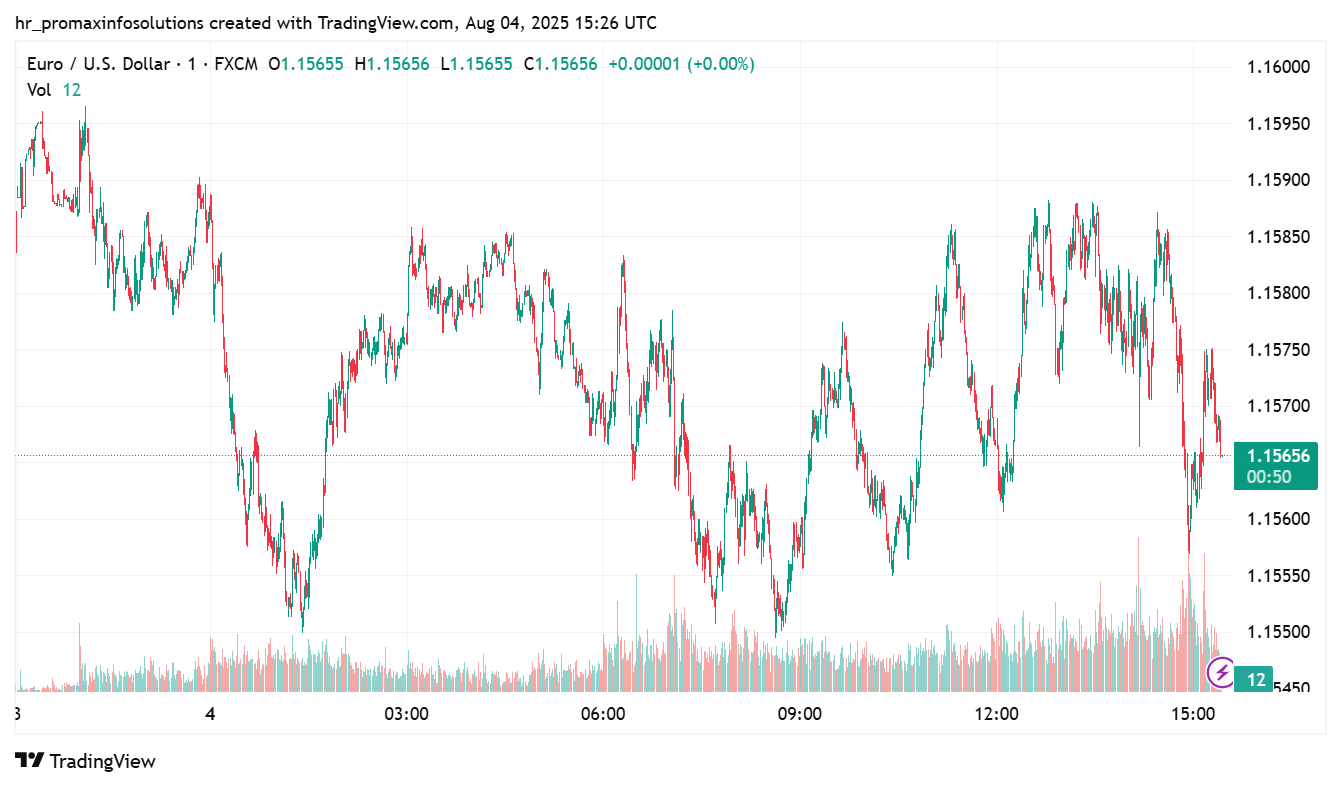

EUR/USD Wobbles After Payroll Miss

The EUR/USD struggled near 1.1557, following downbeat US employment and manufacturing data, which raised questions about the US economic exceptionalism and boosted hopes for a Federal Reserve (Fed) rate cut in September. In July, US Nonfarm Payrolls (NFP) increased by 73,000, compared to a revised 14,000 gain in June (originally 147,000). This figure was below the market expectation of 110,000. The Unemployment Rate in the US rose slightly to 4.2% from 4.1% in June, aligning with expectations. In June, the Core US Personal Consumption Expenditure (PCE) inflation increased by 0.3% MoM, which was in line with market forecasts. Year-over-year, PCE inflation accelerated to 2.6%, surpassing the expected 2.5%. The US ISM Manufacturing PMI showed further contraction in June, with the index dropping to 48.0 in July from 49.0 in June. This decline disappointed markets, which had anticipated an increase to 49.5, raising concerns about the US economy’s momentum. Shortly after the data, the US President announced the dismissal of the Bureau of Labour Statistics (BLS) commissioner, Erika McEntarfer, accusing her of rigging jobs figures, according to him, “to make the Republicans, and ME, look bad”.

Last week, the Federal Reserve (Fed) maintained its benchmark federal funds rate at 4.25%-4.5% during its July meeting on Wednesday, as most analysts expected. Fed Chair Jerome Powell stated in a post-meeting conference that the US central bank has “made no decisions” regarding a policy shift in September and may need more time to evaluate the impact of tariffs on consumer prices. Additionally, the abrupt resignation of Fed Governor Adriana Kugler has heightened speculation that the Fed might restart its monetary easing cycle starting in September. Market experts suggest that the new Governor, appointed by President Trump to succeed Kugler, is likely to favour policies aligned with his economic priorities.

On the Euro front, dismal Eurozone Sentix data dimmed market sentiment around the shared currency. The Eurozone Sentix Investor Confidence Index dropped to -3.7 in August from 4.5 in July, according to the latest survey published on Monday. This marked the index’s first negative reading in four months. The Current Situation sub-index decreased to -13.0 in August from -7.3 the previous month, while the Expectations gauge experienced a sharp decline to 6.0 during the same period. Furthermore, a steady increase in the preliminary Harmonised Index of Consumer Prices (HICP) data for July has reduced hopes of further interest rate cuts by the European Central Bank (ECB) in the near future. The data released on Friday showed that both headline and core HICP rose steadily by 2.0% and 2.2% year-on-year, respectively, slightly exceeding their estimates.

Investors will keenly observe the US factory orders and ongoing trade tariff jitters for fresh impetus on the EUR/USD exchange rate.

English

English