EUR/GBP Struggles Due to Eurozone/UK PMI Data

EUR/GBP fluctuated near 0.8558 after the release of the primary reading of the Purchasing Managers’ Index (PMI) from the UK and the Eurozone for April. The HCOB’s latest Purchasing Managers’ Index (PMI) survey revealed that the Eurozone’s manufacturing sector stayed in contraction. The Eurozone Manufacturing Purchasing Managers’ Index (PMI) improved to 48.7 in April, up from 48.6 in March, surpassing market expectations of 47.5. However, the bloc’s Services PMI fell to 49.7 in April, down from 51 in March, which was below the estimated print of 50.5, marking a five-month low. The HCOB Eurozone PMI Composite registered at 50.1 in April, following March’s 50.9, while the market consensus was at 50.3. Additionally, the HCOB Manufacturing PMI in the Eurozone’s largest economy dropped to 48 this month, compared to March’s 48.3, and exceeded the estimate of 47.6, representing a two-month low. Meanwhile, Services PMI contracted to 48.8 in April from 50.9 in March, with the market forecast predicting a 50.2 print for this period, hitting a 14-month low. The HCOB Preliminary German Composite Output Index stood at 49.7 in April, compared to 51.3 in March and the expected 50.4, reaching its lowest level in four months.

On the policy front, market speculation that the European Central Bank (ECB) will reduce the interest rates again in the June policy meeting weighs on the shared currency. On Tuesday, European Central Bank member François Villeroy de Galhau commented, “Trump has signed up the whole world to a ‘lose-lose game’ on trade based on flawed economic arguments. Trump’s attack on trade dampens economic growth, including for the US, and threatens to undermine financial stability. Villeroy called for de-escalation to avoid a spiral of rising tariffs.”

Conversely, Sterling lost ground following the release of preliminary S&P Global/CIPS PMI data. The seasonally adjusted S&P Global/CIPS UK Manufacturing Purchasing Managers’ Index (PMI) eased to 44 in April, down from 44.9 in March. The data aligned with the market consensus of 44 for the reported period. Meanwhile, the Preliminary UK Services Business Activity Index contracted to 48.9 in April, compared to March’s 52.5, and fell short of the expected figure of 51.3. Market anticipation that the Bank of England (BoE) will opt for monetary policy easing in May’s meeting due to slower-than-expected growth in the Consumer Price Index (CPI) data for March and the uncertainty over the global economic outlook adds pressure on the pound.

In the upcoming sessions, optimism around the US-UK trade talks, the UK’s Retail Sales data for March, and market sentiment around HCOB Purchasing Managers’ Index (PMI) data from the Eurozone and Germany will influence the EUR/GBP exchange rate.

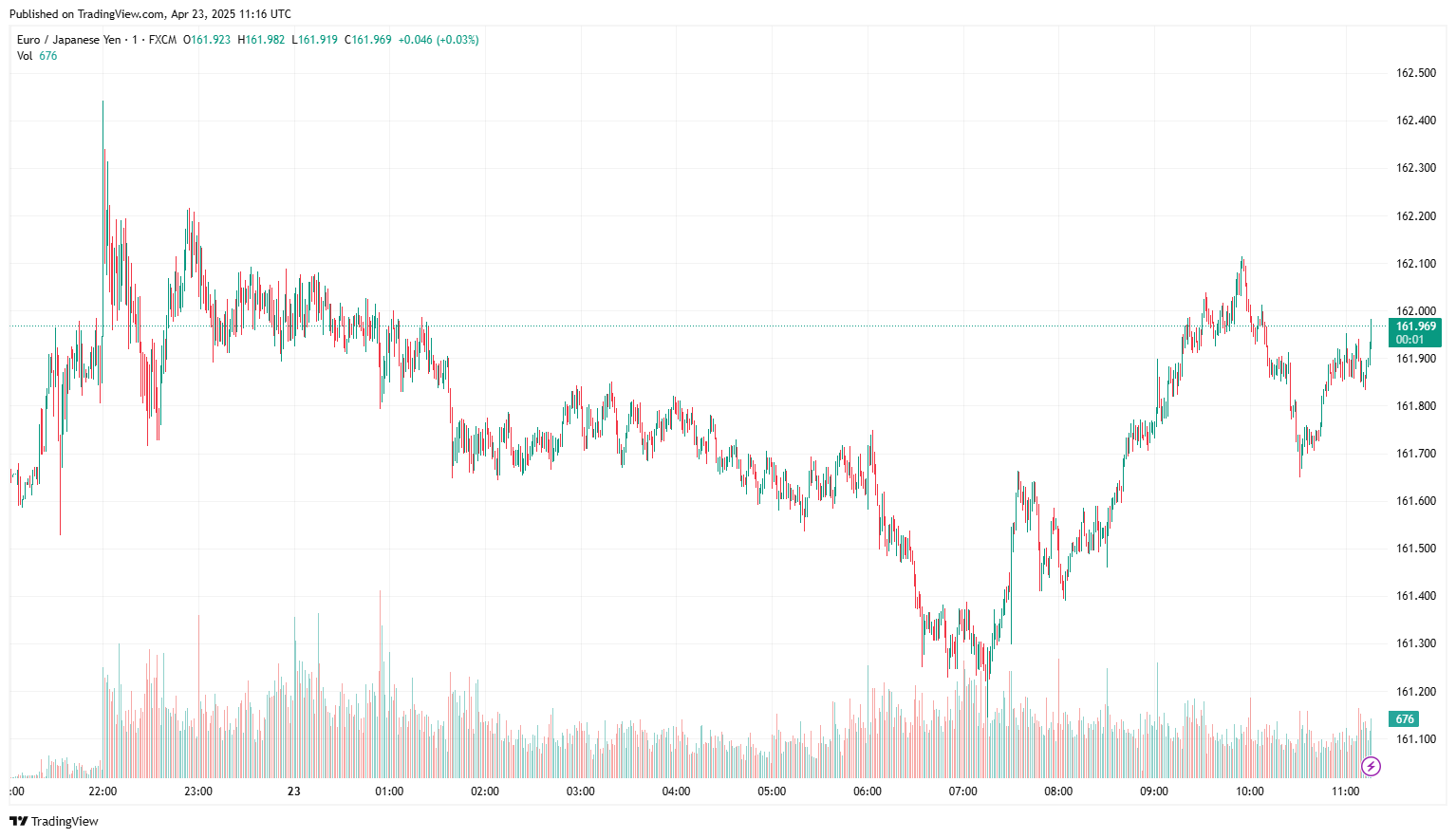

EUR/JPY Rebounds Following Eurozone PMIs

EUR/JPY struggled near 161.75 following the release of the Eurozone’s Purchasing Managers’ Index (PMI) for April. The latest Purchasing Managers’ Index (PMI) survey from HCOB shows that the Eurozone’s manufacturing sector remains in contraction. The Eurozone Manufacturing PMI rose to 48.7 in April, slightly up from 48.6 in March and above the market expectation of 47.5. In contrast, the Services PMI dropped to 49.7 in April from 51 in March, falling short of the estimated 50.5 and marking a five-month low. The HCOB Eurozone PMI Composite was reported at 50.1 in April, down from 50.9 in March, with market consensus at 50.3. Moreover, the Manufacturing PMI for the Eurozone’s largest economy fell to 48 this month, down from March’s 48.3 and surpassing the estimate of 47.6, indicating a two-month low. Concurrently, the Services PMI decreased to 48.8 in April from 50.9 in March, with market forecasts anticipating a 50.2 for this period, representing a 14-month low. The HCOB Preliminary German Composite Output Index recorded 49.7 in April, compared to 51.3 in March and the expected 50.4, reaching its lowest level in four months. Market speculation that the European Central Bank (ECB) will lower interest rates again at the June meeting is pressuring the shared currency. On Tuesday, ECB board member François Villeroy de Galhau remarked, “Trump has engaged the entire world in a ‘lose-lose game’ on trade rooted in flawed economic reasoning. Trump’s trade assaults, intended to slow economic growth, impacting even the US, endanger financial stability. Villeroy urged de-escalation to prevent a cycle of escalating tariffs.”

On the yen’s front, mixed PMI data from Japan failed to steer the currency amid hopes that Japan would strike a trade deal with the US, as well as expectations that the Bank of Japan (BoJ) would continue raising interest rates, supporting the Japanese Yen (JPY). Japan’s National Consumer Price Index (CPI) rose by 3.6% year-on-year (YoY) in March, compared to the previous reading of 3.7%, according to the latest data released by the Japan Statistics Bureau on Friday. Further details reveal that the National CPI excluding fresh food stood at 3.2% YoY in March, up from 3.0% prior. This figure aligned with the market consensus of 3.2%. CPI excluding fresh food and energy increased by 2.9% YoY in March, compared to the previous reading of 2.6%. Meanwhile, the preliminary Purchasing Managers’ Index (PMI) released earlier this Wednesday indicated that Japanese manufacturing activity has declined for the tenth consecutive month in April. The au Jibun Bank manufacturing PMI registered at 48.5 in April, slightly higher than 48.4 in the previous month. In contrast, Japanese services activity rebounded, and the au Jibun Bank Services PMI increased to 52.2 during the reported month compared to a neutral reading of 50.0 in March.

Broader risk sentiment around the ongoing trade conflicts will drive the EUR/JPY exchange rate.

USD/CAD Tumbles Amid Ongoing Tariff Dispute

USD/CAD hovered near 1.3819, following the softer-than-expected inflation data. Statistics Canada announced on Tuesday that the Consumer Price Index (CPI) dropped to 2.3% year-on-year in March, down from 2.6% in February. Month-on-month, the CPI saw a rise of 0.3%, compared to the 1.1% increase noted in February. The Bank of Canada’s (BoC) core CPI, which excludes the fluctuating prices of food and energy, increased by 2.2% over the 12 months leading up to March, a decrease from the 2.7% growth recorded in the previous month. Rising crude oil prices, new sanctions on Iran, declining US crude inventories, and a more dovish stance from President Trump on the Federal Reserve could add more volatility to commodity-linked currencies, including the Canadian Dollar (CAD). On the policy front, market anticipation surrounding the Bank of Canada’s (BoC) monetary policy outlook could influence the currency. Last week, the Bank of Canada (BoC) kept its interest rate unchanged, leaving the new benchmark interest rate at 2.75%.

On the other hand, US Treasury Secretary Scott Bessent commented that the ongoing tariff dispute is “unsustainable,” implying potential de-escalation. On Tuesday, the White House announced advancements in trade talks aimed at reducing the broad tariffs imposed earlier this month. Press Secretary Karoline Leavitt noted that 18 countries have already presented trade proposals, and this week, President Trump’s team is scheduled to meet with representatives from 34 nations to discuss potential agreements. Additionally, US President Trump declared that he had no intention of firing Federal Reserve Chair Jerome Powell, despite his frustration with the central bank’s hesitation to lower interest rates more quickly, highlighting shifts in the economic outlook, which adds volatility to the greenback. On late Tuesday, Federal Reserve Board Governor Adriana Kugler remarked that given that US import tariffs are much higher than anticipated and are expected to raise prices, the Fed should maintain current short-term borrowing costs until inflation risks subside. Neel Kashkari, President of the Minneapolis Federal Reserve, warned that US tariffs hinder economic growth. He stressed that the central bank must prevent these trade policies from spurring long-term inflation.

In the upcoming sessions, Canada’s February Retail Sales data, flash US S&P Global Manufacturing and Services PMI data for April, and comments from influential FOMC members will shape market sentiment around the USD/CAD exchange rate.

AUD/USD Rose Following Australian PMI Data

The AUD/USD recovered to near 0.6415 after the preliminary data from Australia’s Judo Bank Purchasing Managers’ Index (PMI) release, indicating that private sector activity expanded for the seventh consecutive month in April, driven by continued growth in both manufacturing and services output. The Judo Bank Manufacturing PMI decreased to a two-month low of 51.7 in April, down from 52.1 in March. While manufacturing output continued to show expansion, the rise in new orders was modest. Meanwhile, the Services PMI slightly declined to 51.4 from 51.6 in the previous month, and the Composite PMI also fell to 51.4 from 51.6. Recent Reserve Bank of Australia (RBA) meeting minutes highlighted the uncertainty around the timing of the next interest rate adjustment, primarily due to persistent uncertainty in global trade and geopolitics. While the Board deemed the May meeting suitable for evaluating monetary policy, it emphasised that no prior decisions had been established. Additionally, the Board highlighted risks, both positive and negative, confronting Australia’s economy and inflation path.

Moreover, cautious market sentiment regarding the persistent US-China trade dispute continues to undermine the risk-sensitive Aussie despite robust economic growth, industrial production, and retail sales. China’s economy expanded at an annual rate of 5.4% in the first quarter of 2025, matching the pace seen in Q4 2024 and exceeding market expectations of 5.1%. On a quarterly basis, GDP rose by 1.2% in Q1, following a 1.6% increase in the previous quarter, which fell short of the forecasted 1.4% gain. Recent remarks from Trump expressed optimism regarding the ongoing trade negotiations with China, indicating positive signs and adding that tariffs on Chinese goods wouldn’t be as high as 145%; however, he clearly stated that tariffs wouldn’t be exempted entirely. On Tuesday, the White House announced that the Trump administration is making progress in negotiations for trade deals to alleviate the extensive tariffs imposed earlier this month. US Press Secretary Karoline Leavitt stated that 18 countries have already put forth trade proposals to the US, and this week, President Trump’s trade team will meet with representatives from 34 nations to discuss potential agreements.

In today’s session, flash US S&P Global Manufacturing and Services PMIs for April will be a key driver for the AUD/USD exchange rate.

English

English