GBP/USD Slips Ahead of Key US PPI Inflation

GBP/USD edged lower near 1.3544 as investors await the monthly Gross Domestic Product (GDP) for April and the US Producer Price Index (PPI) report. Wednesday’s Consumer Price Index (CPI) rose to 2.4% yearly in May, up from 2.3% and well below the expected 2.5%. The core CPI, which excludes volatile food and energy prices, rose 2.8% in May, matching April’s increase. Monthly, both the CPI and the core CPI increased by 0.1%, compared to analysts’ estimates of 0.2% and 0.3%, respectively. On Wednesday, President Donald Trump expressed via his Truth Social that the trade agreement with China is finalised, pending his and Chinese President Xi Jinping’s approval. “Full magnets, and any necessary rare earths, will be supplied, up front, by China. Likewise, we will provide to China what was agreed to, including Chinese students using our colleges and universities (which has always been good with me!),” Trump stated, adding, “We are imposing a total of 55% tariffs while China is subject to 10%. The relationship is excellent! Thank you for your attention to this matter!” The headline Producer Price Index (PPI) is expected to have accelerated at a 0.2% monthly rate and 2.6% year-on-year from the -0.5% and 2.4% respective readings in April. Any sharp changes in the producer inflation numbers will significantly influence market expectations regarding the Federal Reserve’s (Fed) monetary policy outlook.

On the other hand, recent growth numbers have indicated that the UK economy shrank at a faster-than-expected pace in April, putting pressure on the pound. According to reports from the UK Office for National Statistics (ONS), the UK Gross Domestic Product (GDP) fell by 0.3% month-on-month in April from March’s 0.2%, which was sharper than the expected 0.1%. Meanwhile, factory data also declined at a quicker-than-anticipated pace in April. Month-on-month, Industrial and Manufacturing Production contracted by 0.6% and 0.9%, respectively. This significant contraction in the country’s economy is likely to prompt Bank of England (BoE) officials to reconsider their previous policy guidance of a “gradual and careful” monetary expansion. On Tuesday, the UK Office for National Statistics announced that the ILO Unemployment Rate rose to 4.6% for the three months ending in April, up from 4.5% previously, matching market expectations. The report disclosed that the number of people claiming unemployment benefits increased by 33.1K in May, a shift from a revised drop of 21.2K in April, which was below the anticipated 9.5K. Employment Change recorded 89K in April, down from 112K in March. Concurrently, Average Earnings in the UK, excluding bonuses, rose by 5.2% year-on-year (YoY) in April, compared to the previously revised increase of 5.5%. The market had forecasted a figure of 5.4%. Additionally, Average Earnings, including bonuses, grew by 5.3% during the same timeframe, following a revised acceleration of 5.6% in the quarter ending in March. This, too, fell short of the 5.5% estimate.

In the upcoming sessions, consumer inflation numbers from both economies, along with the market speculations surrounding the BoE’s monetary policy meeting, will influence the GBP/USD exchange rate.

EUR/GBP Gains Following Downbeat UK GDP Data

EUR/GBP gained momentum near 0.8511 as the UK growth numbers dampened the sterling. The UK economy shrank in April, with Gross Domestic Product (GDP) decreasing by 0.3%. This follows a 0.2% growth in March. Market predictions had anticipated a 0.1% decline, according to the latest data from the Office for National Statistics (ONS) released on Thursday. Additionally, the Index of Services for April reported a 0.6% rise over the last three months, compared to March’s 0.7%. Other UK data indicated that both Industrial and Manufacturing Production decreased by 0.6% and 0.9%, respectively, in April, with both figures missing market forecasts. Weaker-than-expected UK GDP data, coupled with disappointing employment figures, has reinforced market expectations that the Bank of England (BoE) will pursue further rate cuts, putting downward pressure on the sterling.

On Tuesday, the UK Office for National Statistics reported that the ILO Unemployment Rate rose to 4.6% in the three months leading to April, up from 4.5%, in line with market predictions. The report also indicated that the number of individuals claiming unemployment benefits increased by 33.1K in May, in contrast to a revised drop of 21.2K in April, falling short of the expected 9.5K. The Employment Change data showed a decrease to 89K in April, down from 112K in March. Meanwhile, Average Earnings, excluding bonuses, saw a year-on-year (YoY) growth of 5.2% in April, compared to a previously revised increase of 5.5%, while market forecasts had anticipated a 5.4% figure. Another measure of wage inflation, Average Earnings, including bonuses, grew by 5.3% during the same timeframe, following a revised 5.6% rise in the quarter ending March. This also failed to meet the expected 5.5%. The data reveals emerging weaknesses in the UK labour market, particularly after Chancellor of the Exchequer Rachel Reeves implemented an increase in employer contributions to social security schemes from 13.8% to 15% in April. This has led UK business owners to lay off a significant number of employees and to recruit fewer workers compared to the previous quarter ending in March, driven by the increased social security contributions.

On the Euro front, hawkish comments from key FOMC members strengthened the shared currency. After the policy meeting, ECB President Christine Lagarde indicated that the central bank might be nearing the end of its easing cycle. Lagarde also mentioned over the weekend that current central bank rates are in a “good position” despite the considerable uncertainty caused by Trump’s tariff threats. On Wednesday, ECB policymaker Martins Kazaks remarked, “It is quite likely that maintaining 2% inflation will require additional cuts for fine-tuning.” He added, “We must be mindful of the risks of a persistent or significant deviation from the target. At present, it seems that the deflationary impact of trade tensions could prevail, although the final outcome remains uncertain. The June cut is meant to ensure that inflation trends towards 2% by 2026.” According to the latest survey released on Tuesday, the Eurozone Sentix Investor Confidence Index, which gauges investors’ views on the Eurozone’s short-term economic prospects, jumped sharply to 0.2 in June, up from May’s -8.1. On Wednesday, ECB Chief Economist Philip Lane stated that the rate cut announced last week will protect against uncertainties surrounding their reaction functions. “This cut helps ensure that the anticipated negative inflation deviation over the next eighteen months stays temporary and does not evolve into a longer-term deviation from the target,” Lane explained.

The UK’s latest GDP figures, optimism surrounding the EU-US trade, and speeches by European Central Bank (ECB) policymakers will influence market sentiment regarding the EUR/GBP exchange rate.

AUD/USD Tumbles Despite Easing US-China Tariff Tensions

The AUD/USD fluctuated around 0.6489 as signs emerged of diminishing tensions between the US and China following the positive outcome of the two-day meetings between the trade representatives of both nations held in London. US Secretary of Commerce Howard Lutnick expressed optimism that both countries will lift export restrictions. On Wednesday, President Donald Trump announced through his Truth Social that the trade agreement with China had been finalised, awaiting his and Chinese President Xi Jinping’s approval. “Full magnets and any required rare earths will be provided upfront by China. In return, we will fulfil our commitments to China, including allowing Chinese students to attend our colleges and universities, which I have always supported!” Trump added, “We are implementing a total of 55% tariffs, while China will face 10%. The relationship is outstanding! Thank you for your attention to this matter!”

On Thursday, Chinese Foreign Minister Wang Yi stated that the government will consistently uphold its commitments, expressing his hope that the US will collaborate with China to implement the agreements made between the two presidents. On the data front, consumer inflation expectations in Australia increased to 5.0% in June 2025, up from 4.1% the previous month, marking the highest level since July 2023. Australia’s Westpac Consumer Confidence rose by 0.5% month-on-month in June, sharply declining from the 2.2% gain in May in response to ongoing uncertainty regarding global trade. The business confidence index improved to 2 in May from -1 in April. Meanwhile, the business conditions indicator fell to zero from 2 in the previous month. Moreover, escalating tensions between Israel and Iran, following the United States’ advice for some Americans to leave the Middle East, coupled with Trump’s comments that the US would not allow Iran to have a nuclear weapon, may hinder the risk-sensitive AUD.

Conversely, cooler-than-expected inflation in the US enhances market speculation about the likelihood of Fed rate cuts, which weakens the dollar. Wednesday’s Consumer Price Index (CPI) for May revealed an unexpected drop, with both monthly and annual figures falling below expectations, thus altering market views on the Federal Reserve’s (Fed) policy approach. In May, the US Consumer Price Index grew by 2.4% year-on-year (YoY), which is a slight increase from 2.3% but lower than the anticipated 2.5% increase. The core CPI, excluding the volatile food and energy sectors, also saw a YoY rise of 2.8% in May, falling short of the expected consensus of 2.9%. Traders will be keenly awaiting the release of the US Producer Price Index (PPI) for May, which tracks inflation at the wholesale level. The monthly PPI for May is anticipated to rise by 0.2%, recovering from a 0.5% drop in April. The annual PPI rate is expected to increase to 2.6%, compared to 2.4% from the previous month. At the same time, the annual core PPI inflation rate, which excludes the more volatile food and energy prices, is projected to hold steady at 3.1%. Moreover, Initial Jobless Claims are predicted to rise to 240,000 over the past week, up from 247,000 reported last week.

In the absence of any major Australian economic release, broader market sentiment regarding producer price inflation will influence the AUD/USD exchange rate.

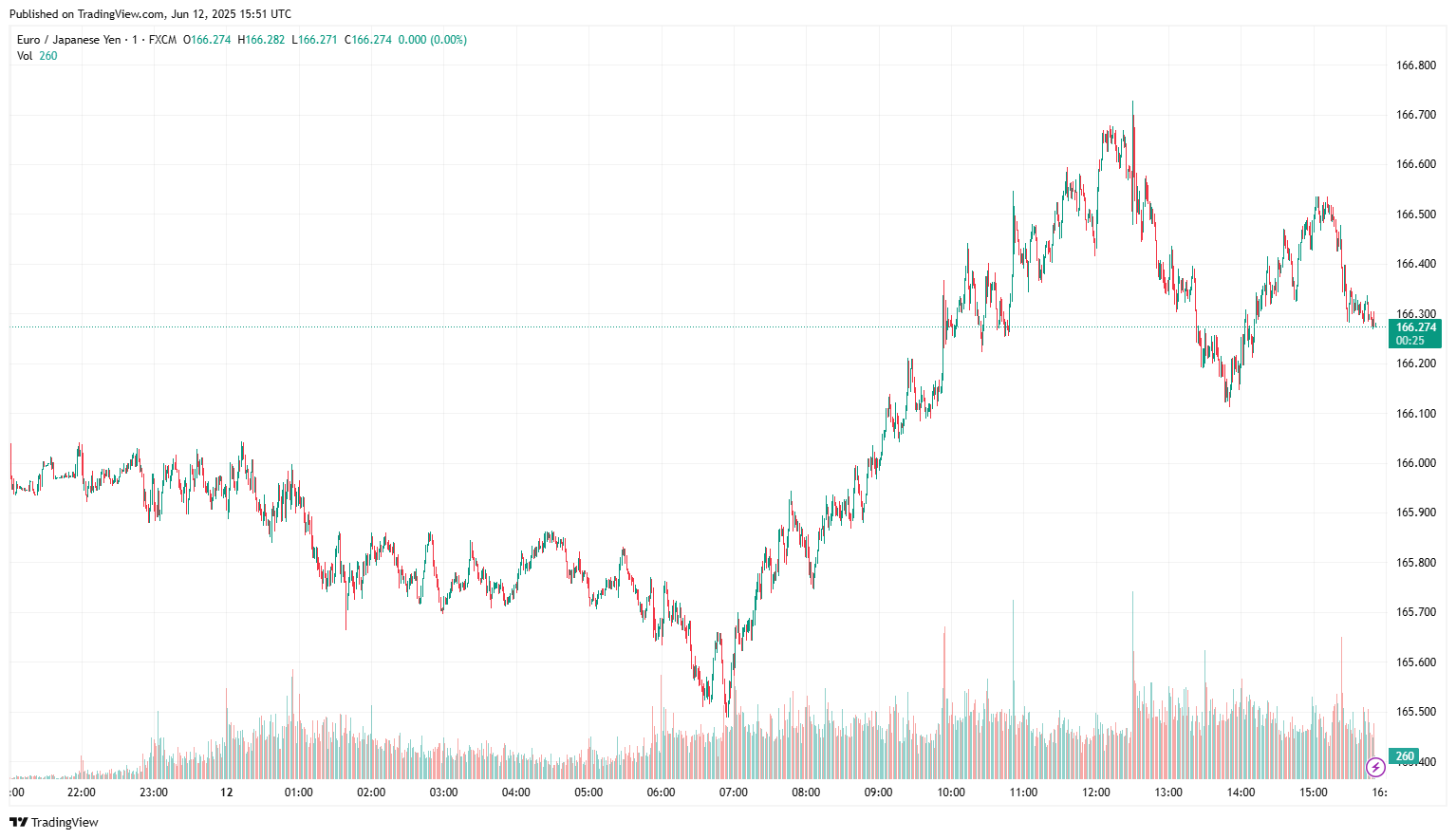

EUR/JPY Buoyed Amid Hawkish BoJ Expectations

EUR/JPY climbed to nearly 165.91, as easing Japan’s annual wholesale inflation, combined with optimism over a positive outcome from US-China trade talks, undermined the safe-haven JPY. Japan’s Corporate Goods Price Index (CGPI), which measures the prices companies charge each other for their goods and services, rose 3.2% in May from a year earlier, falling short of the median market forecast for a 3.5% gain. Regarding US-China trade, Trump conveyed optimism in a post on Truth Social, stating that Beijing has committed to providing rare earths to Washington following their two-day meeting in London earlier this week. Trump wrote, “Full magnets, and any necessary rare earths, will be supplied, upfront, by China. Likewise, we will provide to China what was agreed to, including Chinese students using our colleges and universities (which has always been good with me!).” He also mentioned, “We are getting a total of 55% tariffs, China is getting 10%. Relationship is excellent!” On Wednesday, a Japanese cabinet official cited Bank of Japan (BoJ) Governor Kazuo Ueda during a meeting discussing the monthly economic report. He noted that while markets’ risk-averse behaviour is easing somewhat, uncertainty regarding Japan and international economies remains very high. The BoJ will closely monitor market movements and their impact on the economy.

Meanwhile, the growing acceptance that the Bank of Japan (BoJ) will continue raising interest rates, along with rising geopolitical tensions in the Middle East, supports the yen. Israel is reportedly preparing to launch a strike on Iran’s nuclear sites. In anticipation of this possibility, the US State Department has authorised some staff to leave Iraq, while the Pentagon is permitting military families to depart US bases across the region voluntarily. This development comes as Trump has expressed doubts about reaching a nuclear deal with Iran.

On the Euro front, hawkish remarks from the ECB, along with hopes that EU-US trade talks will influence the euro in the upcoming sessions, have been noted. European Central Bank (ECB) Governing Council member Gediminas Šimkus stated on Thursday, “The ECB has arrived at the neutral level of rates.” He also mentioned that rates might need to decrease further, as there is a heightened risk of inflation falling below projections. It is important to pause on rates; however, I do not dismiss the possibility of another rate cut in 2025. ECB policymaker Francois Villeroy de Galhau also commented on Thursday that there is no definitive stance on upcoming rate decisions. He emphasised that the ECB’s favourable circumstances do not imply that policy is unchanging. Although he does not anticipate deflation, the ECB is equipped with tools to respond to changing conditions, especially since the chaos of the Trump administration impacts global growth.

Broader market sentiment around the hawkish BoJ expectations and speeches by European Central Bank (ECB) policymakers will significantly influence the EUR/JPY exchange rate.

English

English